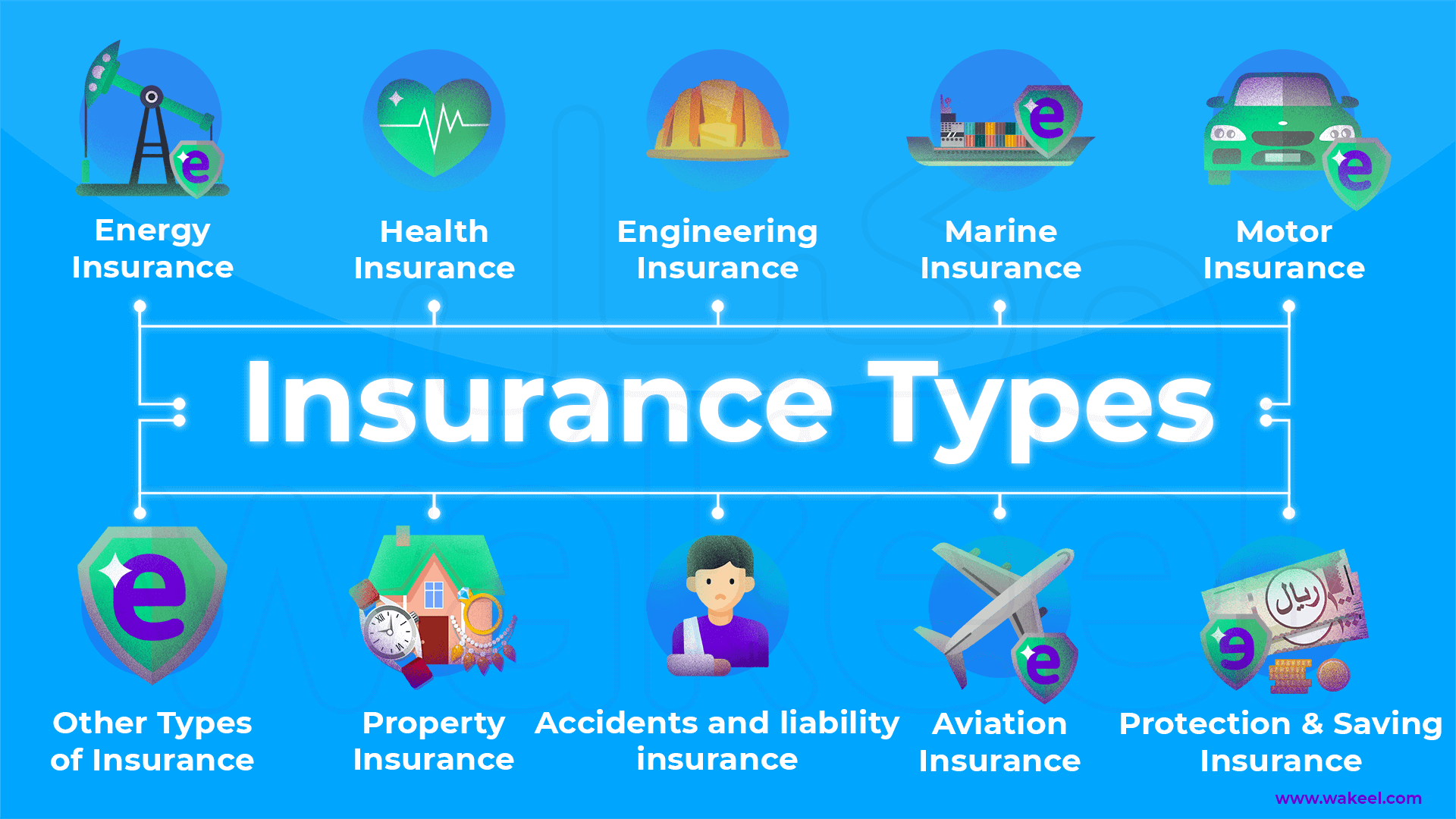

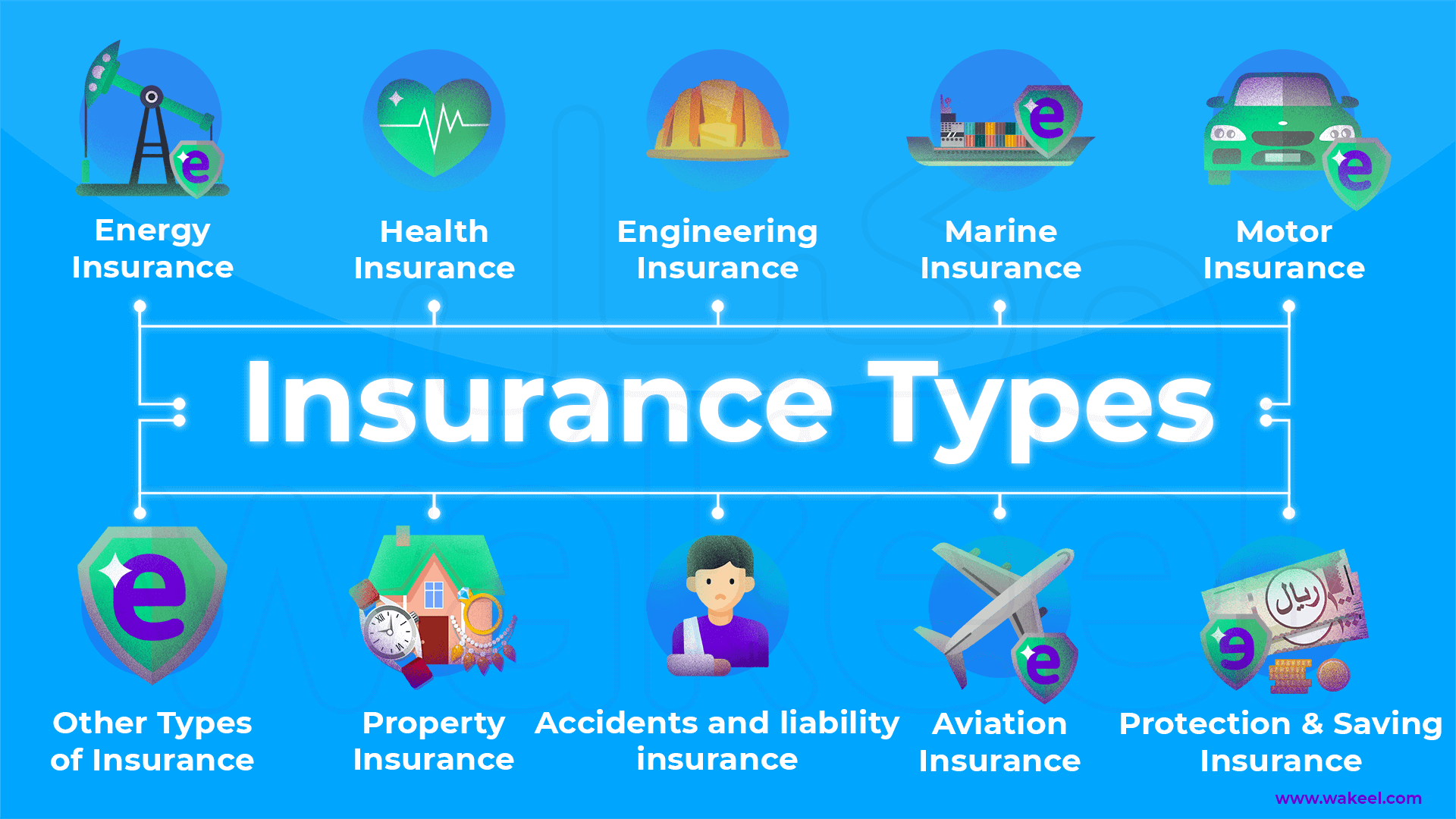

Checking Out the Different Kinds and Utilizes of Insurance for Everyday Life

Insurance plays an important function in day-to-day life, yet many individuals ignore its significance. It encompasses numerous types, each offering certain demands and offering necessary security. From wellness and automobile insurance to life and impairment coverage, these options add to economic safety and security. Comprehending the nuances of each type can encourage individuals to make educated choices. What variables should one take into consideration when selecting the best insurance for their situations?

Comprehending Health Insurance and Its Relevance

Just how vital is medical insurance in today's culture? It is a critical component of financial security and wellness for individuals and households. abilene insurance agency. Medical insurance gives coverage for medical expenses, making certain accessibility to needed medical care solutions without the worry of frustrating expenses. In a landscape where clinical bills can bring about considerable financial obligation, medical insurance acts as a safety net, securing policyholders from financial destroy because of unforeseen wellness concerns

Furthermore, it urges regular examinations and preventive treatment, inevitably adding to better general health and wellness results. With climbing health care expenses, having ample health and wellness insurance is no much longer just a choice; it is a necessity. Numerous strategies deal with diverse requirements, enabling people to select coverage that aligns with their wellness demands and economic abilities. Essentially, health and wellness insurance is not just a policy; it is an important source that promotes safety and security and promotes a much healthier society.

The Fundamentals of Auto Insurance Protection

Auto insurance acts as a crucial safeguard for automobile owners, protecting them versus economic loss from accidents, theft, and damage. This sort of insurance commonly consists of a number of key components. Obligation protection is a fundamental element, covering physical injury and residential property damages caused on others in a crash. Accident coverage, on the various other hand, addresses damages to the insurance holder's vehicle arising from a collision, no matter fault. Extensive insurance coverage shields against non-collision-related events such as burglary, criminal damage, or all-natural calamities.

In addition, numerous policies offer uninsured/underinsured driver protection, which provides security if the insurance policy holder is included in an accident with a chauffeur doing not have enough insurance. Injury protection might also be included, covering clinical costs for the insurance holder and passengers. Recognizing these important elements makes it possible for lorry owners to choose the appropriate protection for their demands, guaranteeing appropriate protection in a variety of conditions.

Home Insurance: Securing Your Many Prized Possession Asset

While homeownership represents a significant accomplishment, it additionally includes the responsibility of safeguarding one's investment with home insurance. Home insurance offers important coverage versus different dangers, consisting of fire, burglary, and natural calamities. By protecting the physical framework of the home and its materials, home owners can reduce potential financial losses from unforeseen occasions.

In addition, home insurance commonly includes obligation protection, which covers legal expenses if someone is injured on the residential property. This facet is essential for protecting homeowners from costly suits.

Different policies supply differing levels of protection, allowing people to tailor their insurance to fit their specific needs (business insurance company abilene tx). Factors such as place, home value, and individual possessions can influence the kind and amount of protection required. Inevitably, home insurance functions as an important economic security internet, making certain that house owners can recuperate and restore after unexpected challenges

Life Insurance Policy: Protecting Your Loved Ones' Future

Life insurance policy offers as a critical economic tool for people looking for to protect their enjoyed ones from the prospective hardships that can emerge after their death. By supplying a fatality benefit, life insurance policy warranties that recipients are monetarily protected throughout a hard time. This economic assistance can cover vital expenses such as home loan repayments, education and learning costs, and everyday living expenses, relieving the concern of monetary stress.

There are numerous types of life insurance policy, consisting of term life, whole life, and universal life plans, each designed to fulfill various demands and choices. Term life insurance policy uses coverage for a given duration, while entire life insurance policy provides lifelong security and a cash worth part. Universal life insurance combines flexibility with a cash build-up feature. Inevitably, life insurance plays a considerable duty in long-term monetary preparation, allowing individuals to leave a long lasting legacy for their families and guaranteeing their enjoyed ones are taken care of in their absence.

The Function of Handicap Insurance in Financial Safety And Security

Impairment insurance plays a crucial function in maintaining financial safety by offering income security in case of unpredicted disabilities. There are numerous sorts of impairment insurance, each designed to meet various requirements and situations. Recognizing these alternatives and their advantages can greatly boost one's economic security during challenging times.

Kinds Of Impairment Insurance

Roughly 1 in 4 individuals will certainly experience a special needs that lasts longer than three months during their functioning years, making the need for impairment insurance important for economic safety and security. There are two main sorts of handicap insurance: short-term and long-term. Temporary impairment insurance usually supplies insurance coverage for a few months to a year, using revenue replacement for short-term specials needs. Long-lasting handicap insurance, on the other hand, extends protection for several years or up until retired life, depending upon the plan. Additionally, plans can differ pertaining to interpretations of impairment, waiting durations, united healthcare medicare advantage and advantage quantities. Recognizing the distinctions in between these types makes it possible for individuals to pick the suitable insurance coverage that straightens with their financial demands and potential threats connected with special needs.

Benefits for Financial Stability

Financial security is a crucial facet of a person's overall health, and impairment insurance plays a significant function in preserving it. This kind of insurance supplies earnings replacement for individuals incapable to function due to ailment or injury, ensuring that essential costs, such as real estate and healthcare, can still be satisfied. By securing versus unanticipated economic burdens, disability insurance allows people to focus on healing instead than financial stress. In addition, it boosts long-lasting economic planning, enabling policyholders to keep their savings and investments. In an unstable economic setting, having special needs insurance adds to an individual's durability, promoting comfort. Inevitably, this coverage is vital for suffering monetary health and wellness and safety despite life's uncertainties.

Navigating Liability Insurance for Personal and Service Protection

Liability insurance is crucial for both individuals and services, supplying protection versus potential lawful insurance claims. Comprehending the subtleties of liability protection enables policyholders to make informed decisions customized to their particular needs. Choosing the best plan can substantially alleviate risks and guard financial stability.

Understanding Liability Insurance Coverage

Recognizing responsibility insurance coverage is necessary for people and businesses alike, as it offers crucial security versus possible legal claims. This kind of insurance safeguards insurance holders from economic losses arising from claims, consisting of expenses connected with lawful defense, settlements, or judgments. Individual responsibility insurance coverage typically shields house owners and occupants from insurance claims involving physical injury or home damage taking place on their premises. Conversely, companies need responsibility insurance to secure against insurance claims originating from their operations, products, or services. By using assurance, liability coverage allows individuals and organizations to take care of risks successfully. Ultimately, comprehending the subtleties of obligation insurance is critical for protecting properties and making sure long-lasting stability in an unpredictable setting.

Picking the Right Policy

Exactly how can people and organizations assure they choose the most ideal obligation insurance policy for their requirements? The process starts with a detailed evaluation of particular risks associated with their tasks. Individuals ought to consider personal obligation threats, while companies have to assess operational dangers, worker tasks, and client communications. Next, recognizing the kinds of coverage available is crucial; options might consist of basic liability, expert obligation, and item liability insurance. Consulting with an educated insurance agent can give customized suggestions and assurance compliance with legal demands. Furthermore, comparing quotes from multiple insurance providers can aid recognize the very best coverage at competitive rates. Eventually, a knowledgeable choice will protect possessions and supply comfort, allowing people and companies to concentrate on their core goals.

Regularly Asked Questions

What Factors Influence Insurance Costs for Different Kinds Of Insurance Coverage?

Numerous elements influence insurance costs, consisting of private danger accounts, insurance coverage kinds, asserts background, geographical location, and the insured's age. Each element adds to the total evaluation of risk by the insurance service provider.

How Do Deductibles Work in Various Insurance Policies?

Deductibles represent the quantity insurance holders should pay out-of-pocket before insurance coverage starts. Various plans might have varying deductible structures, influencing costs and overall expenses, therefore influencing the monetary obligations of the guaranteed.

Can I Have Numerous Insurance Coverage for the Very Same Asset?

What Is the Process for Submitting an Insurance Policy Case?

Filing an insurance claim click to read usually entails notifying the insurance provider, giving essential documents, completing insurance claim forms, and outlining the occurrence. The insurance firm then reviews the case prior to accepting or refuting payment based on policy terms.

Just How Can I Lower My Insurance Expenses Without Giving Up Protection?

To lower insurance prices without compromising protection, individuals can compare quotes, rise deductibles, bundle plans, maintain an excellent credit rating, and ask about discount rates Continued for safe driving or home safety and security features, maximizing their financial method efficiently. car insurance company abilene tx.